Most small investors are not that good at predicting the financial future. I am certainly awful at it and I worked at a trading company for five years. I had a front row seat watching how the big guys run a trading firm today and I can tell you that it takes a lot of specialist knowledge, technology, and money. My job was to run the technology. It is a world that is far removed from the tools and timescale of everyday people.

For investors who don’t have a supercomputers and 10Gb links to the New York Stock Exchange, how do you know when to make trading decisions? A writer for the Wall St. Journal wrote an article a year or two back claiming that a “common sense” trading strategy was the right move for the average Joe. He claimed that investors should buy whenever the market fell by 5% and sell whenever it rose by 5%. The intuition was clear, this model would force people to buy low and sell high.

But does it work? I built a model to test this trading strategy. The original article was a little fuzzy on some of the key details such as how much of your wealth should you move when the market crosses the 5% threshold, so I assumed that to be 5% as well.

Here are the key assumptions for the “Common Sense” (CS) trading strategy:

- Buy or sell when the market falls/rises by 5%

- Every sale results in 15% of your gains going to long-term capital gains taxes

- Every sale is 5% of the value of held shares

- Every purchase uses 5% of free cash

- With an initial $10,000, $7K is invested on day 1 and $3k is held in cash

- Investment was started on 1/3/2006

To compare this against a “Buy and Hold” (BH) trading strategy

- Buy when the market falls by 5% from the last high

- Every purchase uses 5% of free cash

- Never sell

- With an initial $10,000, $7K is invested on day 1 and $3k is held in cash

- Investment was started on 1/3/2006

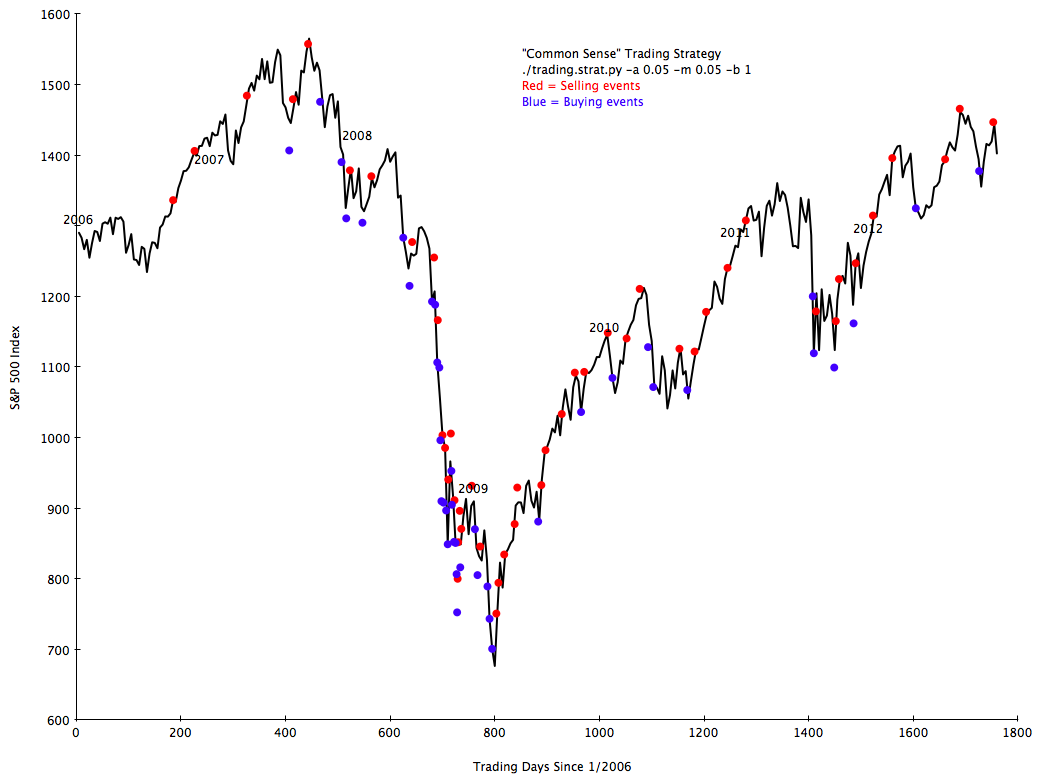

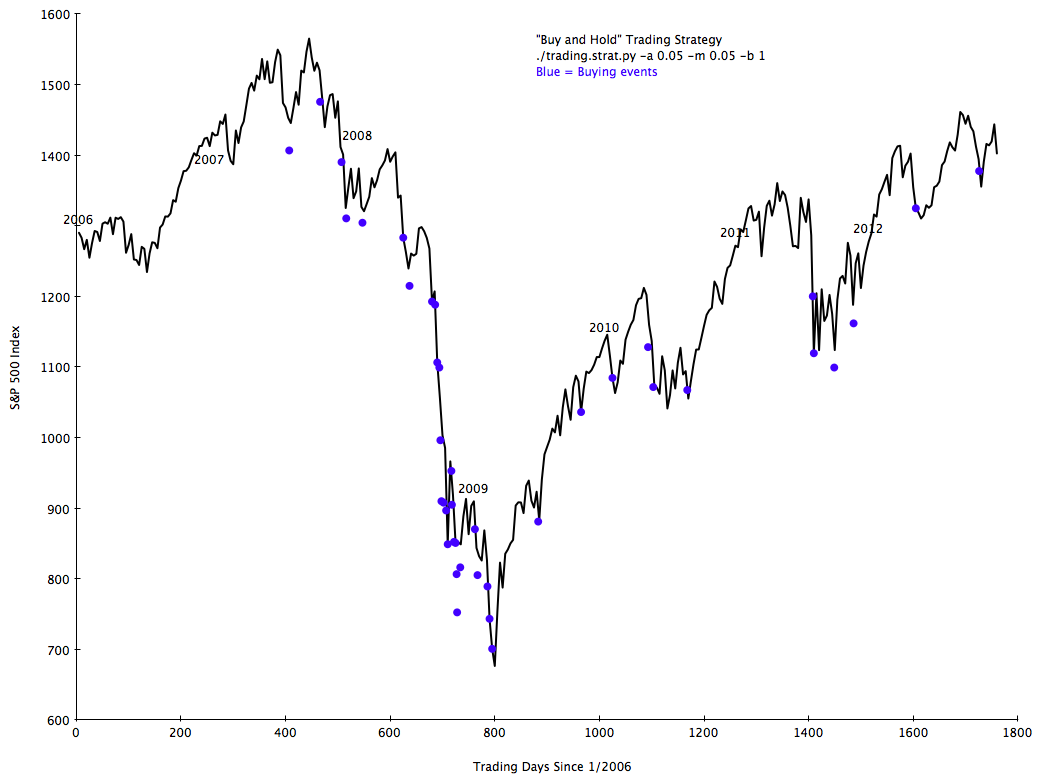

Here are two graphs of the S&P 500 index with the transactions of the two strategies overlaid. The CS strategy has both purchases and sales, the B&H has only purchases. Both strategies make purchases when the market has fallen by 5%. A glance at the graphs confirms that both strategies are doing pretty well at buying during market low points.

First the CS graph. Notice that it Buys (blue) when the market falls and Sells (red) on the way up. It does a great job of hitting all the peaks on the graph:

The B&H has the same pattern of purchases, but never sells any shares:

The B&H has the same pattern of purchases, but never sells any shares:

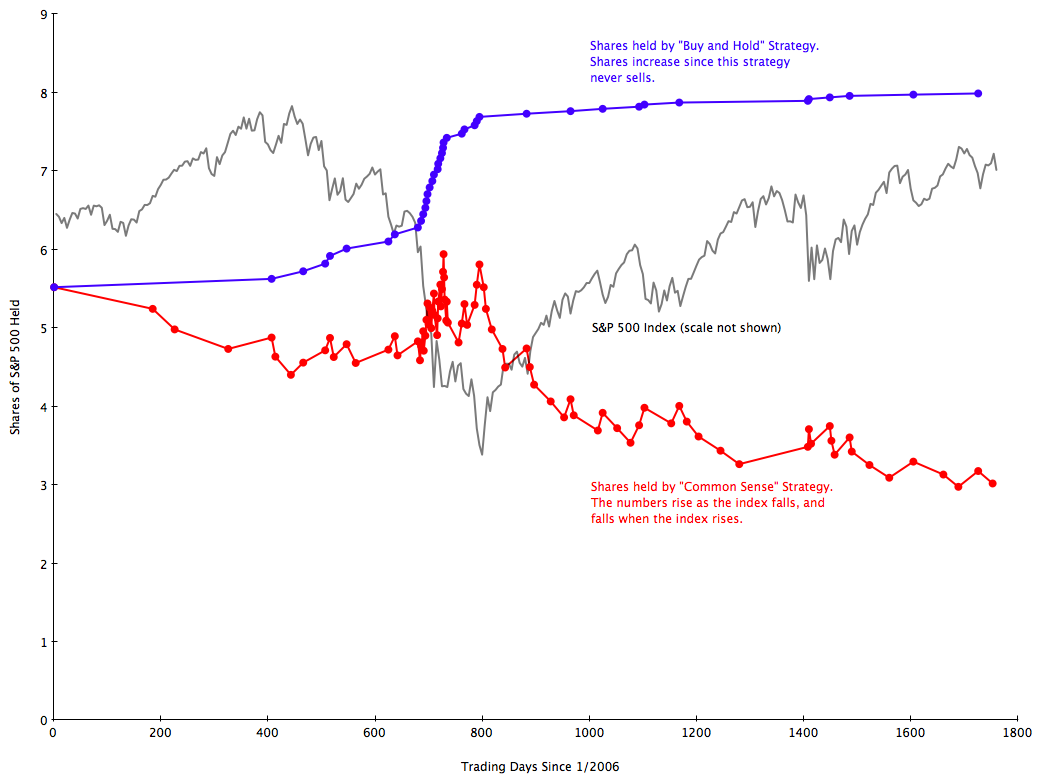

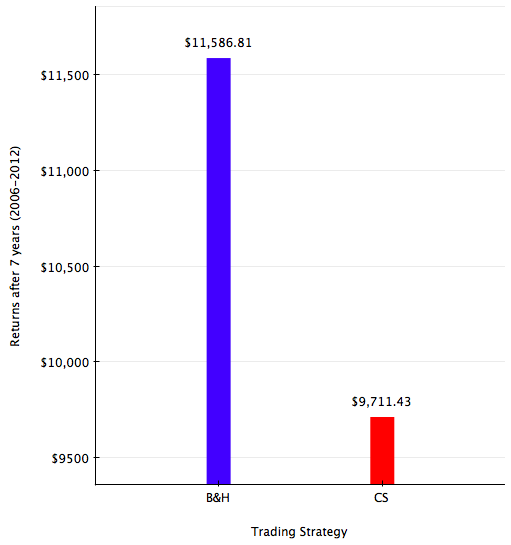

So how did they do? The “common sense” trading strategy is a disaster. Buy and Hold finished with $11,586.81 and “common sense” ended up losing money, ending with only $9,711.43 of the original $10,000. That is $1,875 or 16% worse than the B&H strategy over the seven years.

What happened? Three things are going wrong. First, long-term capital gain taxes suck out a ton of your profits. At 15% of your gains, every sale nibbles away at your purchasing power. The CS strategy paid $1,021 in taxes over the seven years, which is a majority of the performance difference between the two strategies. In the seven years, that $1,021 would have grown by 6.5% to $1,088. Over more time both the money you don’t pay in taxes plus the 6.5% in growth really get big.

Second, the CS algorithm is too risk-averse. It moves too much money out of investments and into cash. Since the market has generally risen for the last 70+ years, there are more selling events than buying events. So the number of shares owned decreases over time as the cash begins to equal the value of the shares you own. You can see in this graph how the B&H strategy ends up with 2.6x more shares. When you money sits in cash, it does not grow.

Lastly, as you purchase new shares over time, you increase the average purchase price of the shares you hold. Since the price of stocks has continued to rise over time, in the future when the market dips by 5%, shares will still cost more then they did on day one. Buying the small dips does not help because they are very rarely deep enough to lower the average cost of your purchases. What seems like a perfectly good idea turns out to be horrible in real life. But are there ways to save the CS strategy? I will give this some more thought and follow up with another post.

Here is the python source code and data if you want to play. CS.Trading.Strat.Source